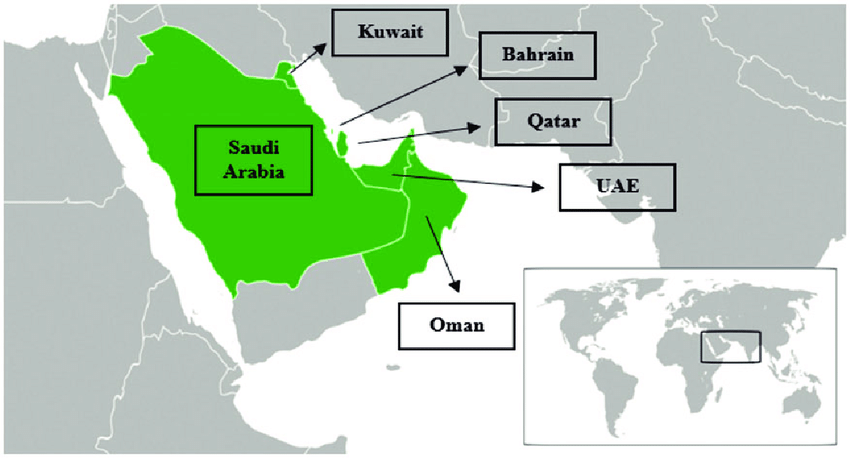

For at least half a century, migrant workers have been the backbone of the employment market in the Gulf countries. The six Arab Gulf states, Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain have the world’s largest concentration of temporary migrant workers, about 10 percent of migrant workers worldwide.

The International Labor Organization (ILO) puts the number of migrant workers in the Gulf States (as well as Jordan and Lebanon) at about. In four of the six Arab Gulf States, the proportion of foreign workers even exceeds the proportion of citizens, and they comprise a majority of the population: 88 percent of people in the UAE, 75 percent in Qatar, 73 percent in Kuwait, and 51 percent in Bahrain are (authorities tend to downplay the number of migrant workers, and there are also illegal foreign workers unknown to the authorities).

Thus, out of a population of 9.5 million residents in the UAE, for example, about are foreign workers. The majority of foreign workers in the Gulf States meet the definition of, with most from Asia (particularly Southeast Asia), while the number of migrants from Africa, and Egypt in particular, is rising steadily.

The Gulf states previously employed many Palestinians (about a million), primarily in Saudi Arabia and Kuwait, but due to their support for Saddam Hussein in the Gulf War, about half a million were expelled, mainly to Jordan. The fate of many Yemenis working in Saudi Arabia was similar, and for the same reason. The official total of annual money transfers from the Gulf states is about, and the main destination countries are India ($50 billion annually) and Egypt ($20 billion annually).

Hiring activity in the Gulf Cooperation Council (GCC) region surged in 2021 and will continue to pick up in 2022, as economies have recovered to pre-pandemic levels, according to a new analysis by recruitment specialist Cooper Fitch.

Overall job creation across the region, including the UAE, Saudi Arabia, Oman, Kuwait, Bahrain and Qatar, jumped by 40 percent in the last quarter of 2021 compared to the same time in 2020, driven primarily by a significant recovery in the UAE and Saudi Arabia.

Significant increases in hiring were observed in real estate, public, software development, cyber security, sales and marketing sectors. There was also more hiring activity within human resources, banking and digital roles.

In its latest Gulf Employment Index released , Cooper Fitch noted that the Gulf economy showed signs of recovery in the second half of 2021 and this was significantly driven by rising production levels and oil prices, as well as easing of COVID-19 restrictions.

“[The] economic indicators look positive, with the [International Monetary Fund] forecasting the economic recovery for the Middle East to accelerate to 4.4 percent in 2022, after initial estimates of 3 percent were revised,” Cooper Fitch said.

Quarterly indicators

On a quarterly basis, however, employment levels appeared to have slowed down slightly, posting only a 2 percent growth in the last quarter of 2021 compared to the previous quarter of the same year.

Among the GCC states, Saudi Arabia topped the hiring charts at 21 percent, followed by Oman (12 percent), Kuwait (11 percent), Bahrain (9 percent) and Qatar (8 percent). The UAE, for its part, saw a quarter-on-quarter decline of 6 percent, but Cooper Fitch attributed the overall and UAE’s slowdown to the holiday period.

“It is very important to look at the overall growth of the UAE in 2021 compared with 2020. The UAE typically has a slight slowdown in larger parts of the job market [such as banking, consulting, strategy], as they wait to understand year-end performance. These numbers typically get seasonally adjusted,” Trevor Murphy, CEO of Cooper Fitch, told.

Where the jobs are

Among the job markets included in the review, the public sector registered the highest quarter-on-quarter increase in employment levels at 25 percent.

Hiring was also strong in real estate, up by 16 percent, as well as in banking (14 percent), legal private practice (9 percent), legal in-house (8 percent) and advisory (5 percent).

There was a slowdown in hiring in the manufacturing sector, which posted a decline of 14 percent, as well as in supply chain, down by 11 percent; investment (-9 percent); finance (-5 percent) and senior finance (-4 percent).

For the year ahead, Cooper Fitch said it is forecasting “high single-digit” increase in job creation across each of the countries in the Gulf region.

“The GCC looks set for a positive employment year in 2022 with each country focused on delivering against their medium and long-term strategies around job creation,” the report said.

High growth sectors in the GCC for jobs in 2022

New tech

Cyber security

Sales & marketing

Software development

Legal

Banking

Consulting

Investment M&A

Real estate

Medium growth sectors in the GCC for jobs in 2022

Public sector

Advisory

HR

Finance

Supply chain

Manufacturing

By now gulf rulers have tried almost everything. For much of the region’s modern history well-paid government jobs have been a birthright for citizens. This perk forms the core of the region’s social contracts: cushy, lucrative employment in exchange for the deprivation of political rights.

Worried about growing populations and uncertain oil revenues, though, Gulf States have spent the past two decades trying to persuade and prod their pampered subjects to work for privately owned firms. It has been a real-world experiment in economics—and a largely unsuccessful one at that.

The Middle East travel and tourism sector will create 3.6 million jobs in the next 10 years, the World Travel and Tourism Council forecast in its latest economic impact report, The National reported.

“After a very difficult couple of years, the future is looking brighter with travel and tourism expected to create 3.6 million new jobs across the Middle East over the next decade,” said Julia Simpson, WTTC president and CEO.

In the report, WTTC also added that the travel and tourism sector will see an economic recovery in the region, with its average annual growth outpacing the overall economy for the next 10 years.

The report further stated that the travel and tourism sector’s gross domestic product will grow 7.7 percent on an annual basis between 2022 and 2032, to reach $540 billion — 10.1 percent of the region’s total economy in the next 10 years.

Simpson added: “Looking to this year and the next, the outlook is more positive with both GDP and employment set to almost reach pre-pandemic levels…the recovery of the sector in the Middle East last year was certainly slower than expected, due in part to the impact of the omicron variant.”